Kazakhstan’s industrial output goes down by 2.2% year on year in Jan-Apr 2016

11 July 2016

61

Kostanay Region becomes regional outsider with 15.7% slump.

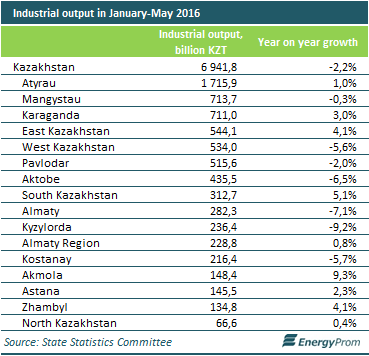

In money terms industrial output totalled KZT6,941.8bn in Kazakhstan in the first five months, with the physical volume of industrial production down by 2.2% year on year.

This trend was largely caused by a fall in output in certain raw materials, unfavourable domestic demand and poor conditions for exports due to a collapse in prices on raw materials markets and recession in the Russian economy. Hopes for a weak tenge supporting industrial production and strengthening external demand from foreign consumers dwindled, affecting domestic demand. Nevertheless, the depreciation of the national currency had a positive impact on financial indicators of oil and gas and other export-based industries.

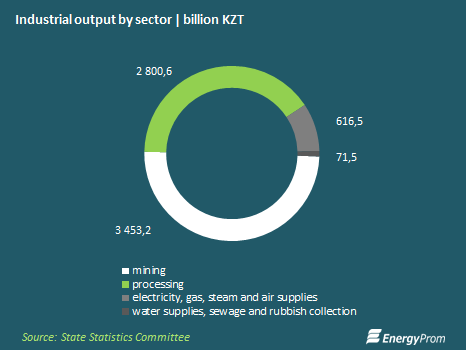

The processing sector posted an insignificant growth in industrial output – 0.5% per year, above all, in the metals industry which increased output by 8% and the rubber and plastics industry by 7.3%. Sluggish investment demand led to a considerable contraction in the machine-building sector by 28.1% year on year.

However, certain improvements in the processing industries did not bring industry as a whole to a positive trend as the extractive sectors contracted. Raw material extracting enterprises reduced output by 4.3% on average from the same period of 2015. For example, iron output fell by 23.1% and coal and lignite by 10.5%. The output of Kazakh key export item – crude oil and condensate – continued a downward trend, falling by 4.4% year on year to 32.38m tonnes.

Industrial output showed significant growth in Akmola and South Kazakhstan Region – by 9.3% and 5.1%, respectively. The sharpest fall was in Kostanay Region (15.7%) and Kyzylorda Region (9.2%). Atyrau remained the unconditional leader in terms of industrial output in money terms.

Popular articles

Watch allWho and why does Kazakhstan’s saiga antelope give trouble?

Experts question the department’s statistics, as well as decisions made at state level regarding saigas In early summer, there Читать далее...

28 June 2022

128

Safeguarding the nature: investment into environmental protection increased by 34% over the year

The number of fixed point sources of pollution in 10 years has increased by 58% Environmental issues are extremely Читать далее...

5 November 2021

104

Focus on ESG: the world is confidently switching to green rails and sustainable development principles

In Kazakhstan, only some of the major backbone companies, major market players, and national development institutions are ready to implement Читать далее...

5 November 2021

91

Renewable energy generation capacities goes up by 40% year-on-year in Kazakhstan in 1Q2016

Clean energy generation jumps by 130% year-on-year in this period

22 June 2016

83

Production of equipment for the oil and gas sector increases by 82.5% year on year in January-July 2016

The sector is boosted by key projects such as the launch of oil production at the Kashagan field expected in the fourth quarter of this year

1 September 2016

76

Power generation reaches 53.7bn kWh in January-July, up by 1.7% year on year. Gas turbine power plants with a capacity of 100,000 kW worth KZT18.6bn were commissioned in the first half of the year

Electricity tariffs went up by 5.8% year on year in August

16 September 2016

71

Output of unrefined and semi-refined gold increased by 21.5% year on year, that of refined gold by 16.5%

Jewellery prices jump by 20.1% year on year on average in Kazakhstan, by 50% in Astana

6 September 2016

65

Kazakhstan’s industrial output goes down by 2.2% year on year in Jan-Apr 2016

Kostanay Region becomes regional outsider with 15.7% slump

11 July 2016

61

Industrial enterprises navigate to sustainable development

Major industrial companies’ investments into social and infrastructure projects in 2019 exceeded 140 billion Tenge Kazakhstan has been holding Читать далее...

5 November 2021

59

Kazakh oil refineries supplied 73.3% of motor fuel consumed and 97.4% of diesel fuel consumed in the country. Petrol output increased by 10.6% and production of gasoils by 3.6%

The price of the most popular octane-93 petrol increased by 16.4% year on year to KZT125 per litre in July. The price of summer diesel increased by 3.3% year on year to KZT99 per litre

15 September 2016

57

Hotel rates increase by 11.1% year on year in June 2016, health resorts by 11.5%

The number of hotels, rest homes and other facilities to accommodate tourists increased by 12.7% in the past year

5 August 2016

54

Kazakhstan’s crude oil and gas condensate output fall by 3.4% year on year in January-July 2016

In July 2016 crude oil and condensate went down by 0.9% year-on-year

26 September 2016

54